Did you know the rules for deducting business-related meals and entertainment expenses have changed?

The Tax Cuts and Jobs Act (TCJA) eliminated most deductions for business-related entertainment expenses incurred after Dec. 31, 2017.

It used to be that 50% of most entertainment expenses could be deducted if they were directly related to conducting business or trade.

Now, there is NO ALLOWABLE DEDUCTION for business-related entertainment expenses at all.

As a result of the new entertainment rules, meal expenses must be carefully evaluated for deduction eligibility.

If a meal can be considered entertainment, then TCJA says it may NOT be deducted.

But, if the meal is not entertainment, then businesses may still deduct 50% for food and beverages given to employees at an eating facility or in the workplace.

Overtime meals are no longer 100% deductible; they are now 50% deductible.

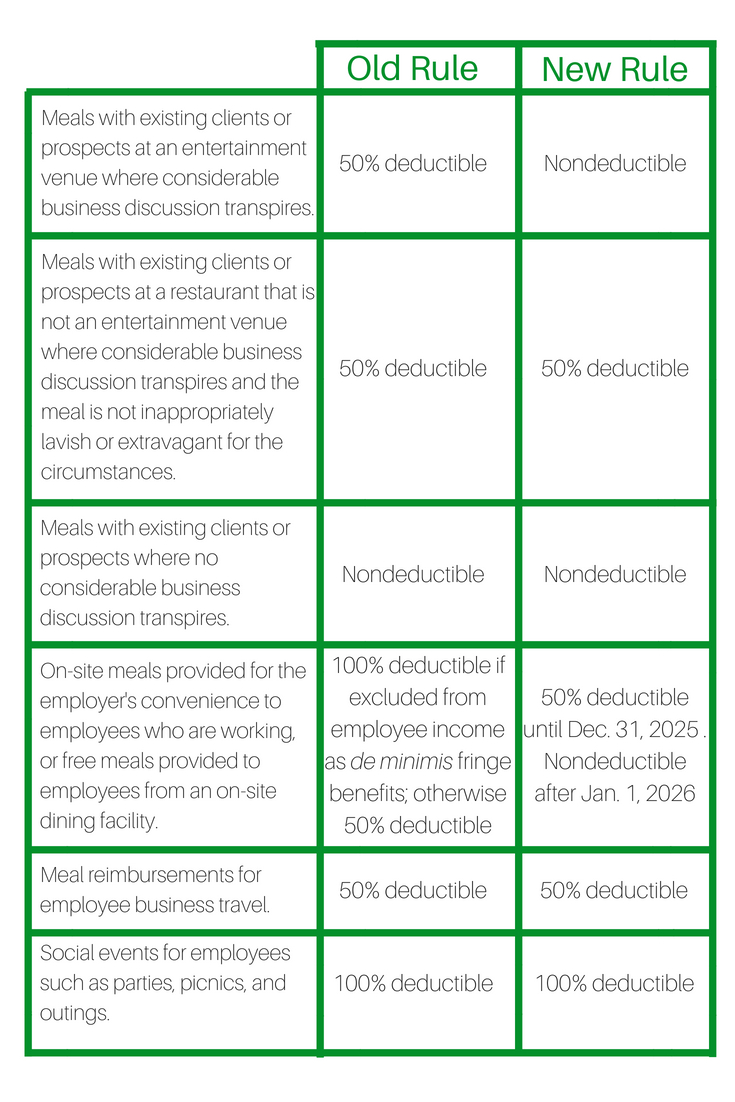

Sherman Oaks Accounting & Bookkeeping powered by One Source Services, Inc. included the quick-reference chart below to summarize TCJA’s effect on meals and entertainment expenses as of 2018:

When planning meals and entertainment expenses after Jan. 1, 2018, it’s imperative that businesses consider the changes proclaimed by TCJA.

The new rules apply to all businesses, regardless of when their fiscal year-end may be.

Therefore, fiscal year taxpayers should be especially careful because the new TCJA rules apply to expenses incurred beginning Jan. 1, 2018 with no consideration for their fiscal year-end.

Sherman Oaks Accounting & Bookkeeping powered by One Source Services is here for you. Please let us know if you have questions. We are happy to help!